Since the beginning of this year, global maritime prices have continued to fall in the context of a high base in the early stage, and the decline trend has accelerated since the third quarter.

On September 9, data released by Shanghai Shipping Exchange showed that the freight rate of exports from Shanghai Port to the Meixi Basic Port market was $3,484 /FEU (40-foot container), down 12% from the previous period, and the lowest since August 2020!

On September 2, the rate fell more than 20 per cent, from above $5,000 to "three"

The industry expects that overseas high inflation squeeze demand, the downward pressure of the economy is intensifying, compared with last year's shipping price of tens of thousands of dollars, the fourth quarter of the global freight market is still not optimistic, or will appear in the peak season is not prosperous market, freight rates will fall further.

Freight rates on the West Coast are down 90% from last year's high!

The third quarter is the traditional peak season for the global freight market, but this year freight rates did not rise as expected, but a rare sustained decline.

On September 9, the Shanghai Export container composite freight Index released by the Shanghai Shipping Exchange was 2562.12 points, down 10% from the previous period, recording the 13th consecutive week of decline. In the 35 weekly reports it has released so far this year, it has fallen in 30 of them.

According to the latest data, the freight rates (sea freight and surcharge) exported from Shanghai port to the basic port markets of the West and East of the United States were $3,484 /FEU and $7,767 /FEU on the 9th, down 12% and 6.6% compared with the previous period, respectively. The price of the West and the United States recorded a new low since August 2020. On Sept. 2, the U.S.-West route fell 22.9 percent to $3,959 /FEU from $5,134 on Aug. 26. The cumulative decline in the past two weeks is more than 30%; With prices at $7,334/ FEU on July 1, the U.S.-West route has fallen more than 50% since the third quarter

Considering that the price of some routes to the West of the United States last year topped $30,000, the latest freight of USD2850/HQ has fallen by 90% compared with the high of last year!

Shanghai Shipping Exchange report pointed out that the recent performance of China's export container transport market is relatively low, the transport demand lack of growth momentum. For North American routes, the outlook is stagflationary at a time when the Federal Reserve will continue to tighten to contain inflation. In the recent week, the performance of the transport market failed to improve, and the fundamentals of supply and demand were relatively weak, leading to the continued downward trend of market freight rates.

It is worth mentioning that the Shanghai Composite index of export container freight rates showed that freight rates fell for 17 consecutive weeks from the peak of the beginning of the year, then rebounded for 4 weeks, and then fell for another 13 consecutive weeks, falling below the level of the same period last year in late July. The market falls and falls, even in a day, can reach hundreds of dollars.

In other important data, Drury's World Container Freight Index (WCI) has declined for 28 consecutive weeks, falling 5% to $5,378.68 /FEU in the latest period, down 47% from a year ago and 46% higher than the 5-year average of $3,679; The FBX global composite index of freight rates was at $4,862 / FEU, after falling 8% last week

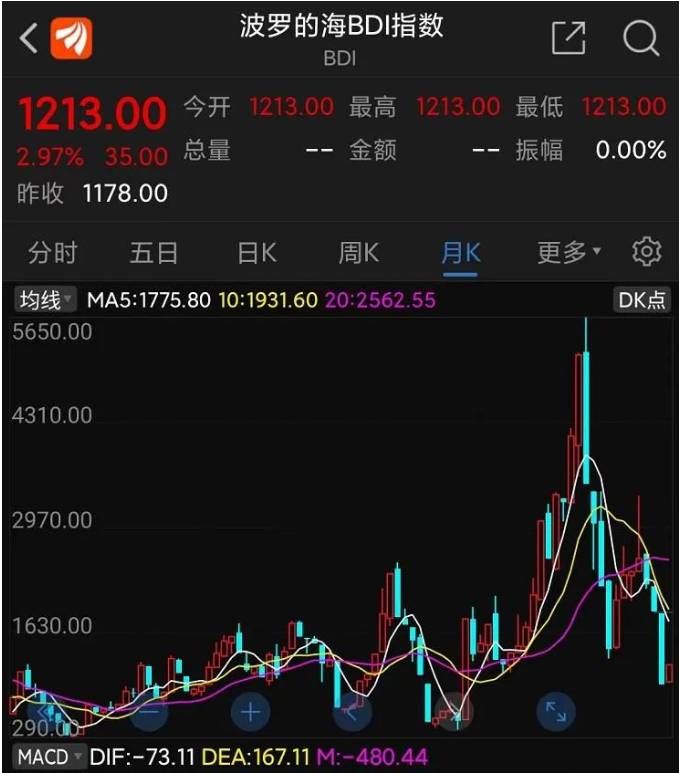

The Baltic Dry index of freight rates rose 35 points or about 3% to 1,213 on Friday, after rising 11.7% last week to its highest level since mid-May. But after falling more than 49 percent in August, the index is also at its lowest level in nearly two years.

At the same time as freight rates plummeted, and shipping company stock prices

Recently, the shipping market price has fallen in the stock price of listed companies have reflected.

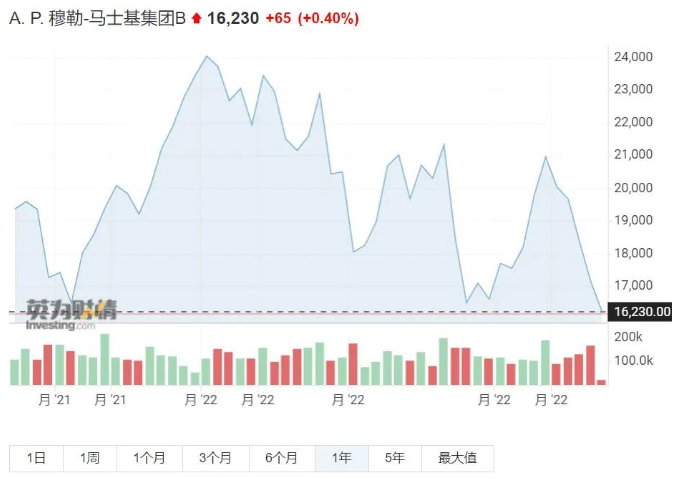

At the end of June, the Marine sector has seen a wave of overshooting. Most shipping companies saw their share prices rebound sharply after the second quarter earnings were still strong, and investor sentiment increased. However, due to the continuous decline in shipping prices, the share prices of the sector turned downward again recently, Maersk, Evergreen, Yangming and other companies once recorded a new low this year.

In early September, some listed shipping companies disclosed their August results, which also showed a market pullback. Wanhai's revenues of T $21.3bn in August were the lowest in nearly a year and down 13.58% from the same month last year. Yangming's revenues were T $35.1bn, down from a year earlier to a single-digit growth of 7 per cent. Evergreen Marine's revenue slowed to T $57.4bn, up 14.83% year on year.

On Sept. 7, Zhang Shaofeng, Yangming's chief shipping officer, admitted that in May he had been too optimistic about stabilizing freight rates and that the market downturn had exceeded expectations, and that container carriers did face pressure from shippers to renegotiate their contract rates.

Zhang Shaofeng said, due to the inflation depressed consumption, freight rate due to cargo is continuous at the "normal", for the past two years in Europe and the line rate of up to five digits in abnormal situation no longer, but not back to $2000 before disease and low water level, then look at 10 months, if the economic outlook toward the positive development of ocean shipping is expected to follow, Rates have a chance to stop falling or even rebound.

Maersk's Asia Pacific operations center president, Andrew Coan, said earlier that shipping operations in Asia were relatively stable and that the company was now focusing on Europe, which faces challenges such as strikes, drought-induced river levels and a shortage of truck drivers. The priority of the Maersk Asia team is to minimize the impact of these issues through global collaboration, closely monitoring developments and ensuring that customers are provided with up-to-date information to help them meet global supply chain challenges.

Peak season is not prosperous, set card industry suffered the worst market in 10 years?

As an important participant in the maritime market, the collection of card drivers on the perception of the market is very deep. In the past, there have been long queues before the Mid-Autumn Festival and National Day as shippers rush to deliver goods, but this year the situation has changed.

Recently, a netizen posted a video saying, "The Waigaoqiao wharf in Shanghai is full of container trucks, stretching for dozens of kilometers." Reporters visited and found that such videos are exaggerated. But in terms of the industry status quo, many set card drivers reflect the market situation is indeed some low.

Yang, who has been engaged in transportation around Shanghai Port for a long time, said that in the past two years, the number of vehicles collecting cards is large and the market competition is fierce. However, due to the repeated epidemic, the situation of "more cars and less goods" makes freight practitioners bear greater pressure.

In Shenzhen, Yantian Port, Shekou road around there are also more container car parking. The reason, the industry pointed out that, on the one hand, in the case of less cargo, container truck drivers have to wait for a long time for orders, parking at the roadside is more convenient, but also save parking fees, even at the risk of illegal parking is "fine"; On the other hand, many parking lots have been developed for other uses, and the parking space has been greatly squeezed, which makes it inconvenient for drivers to park.

Driving set card about 13 years of Master Hu told reporters that the market vehicle, relatively small volume of goods, fierce competition, let the driver order pressure double. With oil prices high, container truck orders are cheap, making it harder to support happy profits. "I used to get orders almost every day, but I've made three orders since September." Mr. Hu said drivers often choose to take breaks when they are not satisfied with the price.

Mr Wu, who is about to retire, admits that in his more than 10 years of container trucking at the port, "the market this year is the weakest". "I used to be able to bargain with logistics companies when I took orders, but now there is almost no room for negotiation," Wu said.

The fourth quarter for the shipping industry was grim as global demand weakened

For the global transportation market, the third quarter is the traditional peak season. But from July to September this year, the market failed to recover as scheduled, but continued to fall under pressure, so that many insiders sigh that the "seller's market" has completely transformed into a "buyer's market".

Maersk's earlier report noted that the weak economic outlook in major Western economies and still-sluggish consumer demand had contributed to a lackluster performance during this year's peak period.

Medium-term futures researcher Chen Zhen founder securities times reporter interviewed said that from the point of capacity on demand side, affected by the conflict between Russia and Ukraine negative spillover and Europe and the United States central bank to raise interest rates faster, increasing global economic downward pressure, already in technical recession in the United States, the European economic downward pressure is bigger, same demand growth slowed sharply in Europe and America, Big US retailers have cancelled billions of orders.

On the supply side, the global container capacity grew by 3.9% year on year in the third quarter, which was at a medium level in the recent seven years. Due to the weak demand, the idle rate of capacity hit the peak in the past five years. Although there were strikes in many European and American ports, the overall trend of port operation efficiency and ship turnover efficiency increased with the lifting of COVID-19 control measures in many countries, resulting in an increase in actual capacity supply.

Chen Zhen believes that the fourth quarter of the global freight market is still not optimistic, there will be a low peak season, freight rates will fall further. Rates in the fourth quarter are certainly well below last year's levels and even lower than in the third quarter of this year. In addition, in the next four months of this year, the volume of new ships will be relatively limited, but there will be concentrated launching in the next two years and more countries will relax the epidemic control, which will increase the pressure of capacity supply sharply. Spot rates will weaken further next year, and long - term rates will also fall sharply next year.

Shassie Levy, chief executive and founder of Shifl, a digital shipping platform, believes that before the pandemic, prices from China to Los Angeles could be as low as $900 to $1,000, at which point shipping companies would lose a lot of money. Now, the ports of New York and Los Angeles are seeing sharp rate declines, and those rates will have a ripple effect, pushing demand and rates down even further. But Levy notes that while freight rates are down from their highs, they are still nearly twice as high as they were before the pandemic. The market seems to be returning to healthy competition, and freight rates will return to the point of full competition.

Post time: Sep-15-2022