On the evening of July 6, CoSCO Released the forecast of the 2022 half-year performance. According to the preliminary calculation, it is expected that the net profit attributable to shareholders of listed companies in the first half of 2022 is about 64.716 billion yuan, an increase of about 27.618 billion yuan year-on-year, an increase of about 74.45% year-on-year. It is estimated that in the first half of 2022, net profit excluding non-recurring gains and losses attributable to shareholders of listed companies is about 64.436 billion yuan, an increase of about 27.416 billion yuan year-on-year, an increase of about 74.06% year-on-year. It is estimated that the company's earnings before interest and tax (EBIT) in the first half of 2022 will be about 95.245 billion yuan, an increase of about 45.658 billion yuan and a year-on-year increase of about 92.08%.

1. As for the reasons for the pre-increase in performance, CoSCO said that in the first half of 2022, the supply and demand relationship of international container transportation was relatively tight, and the export freight rates of trunk routes remained high. During the reporting period, the average of China's export container freight Rate Composite Index (CCFI) was 3,286.03 points, up 59% year on year.

2. Cosco said that during the reporting period, due to the impact of the epidemic, the global supply chain experienced serious delays, and global customers put forward higher requirements for the stability and resilience of the supply chain. In the open sea control always uphold the "customer as the center" the management idea, safeguard capacity supply and box needs, provide "water transfer", "water transportation" and other flexible alternative, give full play to the technological innovation and the important role of digitization in the supply chain system, doing everything they can to help customers through challenging times, in order to guarantee the stability of the global supply chain.

3. Ports on the East and Gulf Coast are using any means available to improve efficiency in response to a sustained surge in freight volumes over the summer, which is likely to add to the backlog of ships already lining up outside the ports, including using nearby land to store imports and empty containers.

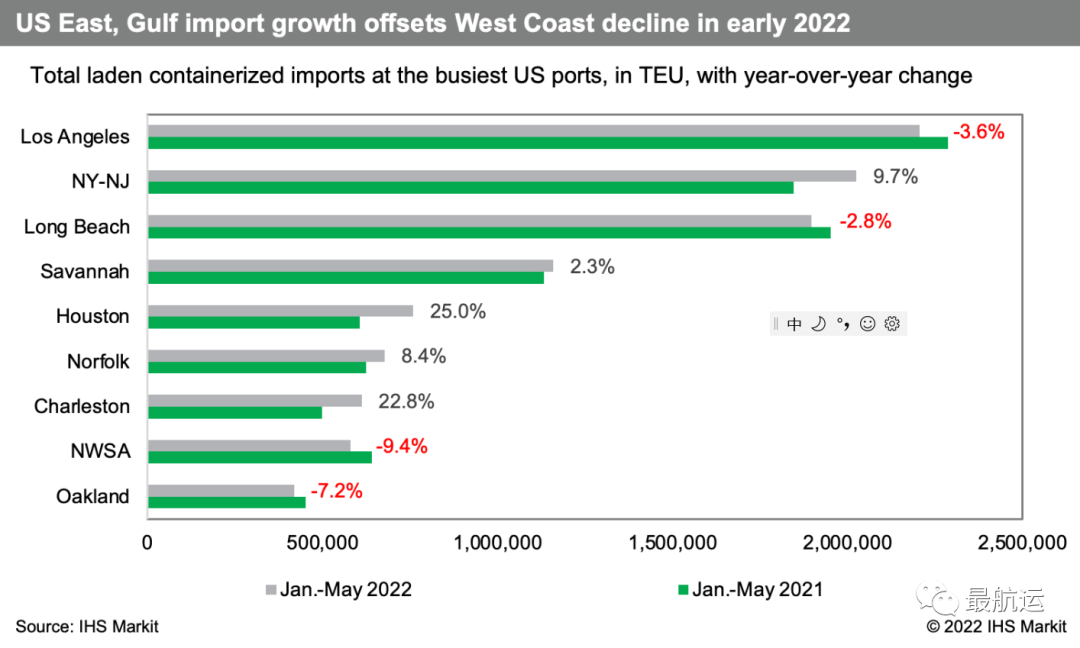

Total US imports rose 3 per cent in the first five months of the year after rising 13.1 per cent in the whole of 2021 as consumer demand continued into 2022, despite inflation warnings and a shift to services spending, according to PIERS. However, the growth is uneven, with shippers shifting cargo from the West Coast, driving east Coast and Gulf Coast shipments up 6.1 per cent and 21.3 per cent respectively, while West Coast imports fell 3.5 per cent.

5. Part of this increase can be attributed to normal seasonality; Retailers and other importers tend to ship non-time-sensitive holiday merchandise to the East Coast earlier in the summer and use the West Coast to expedite shipments closer to the holiday season. The difference this year is that east Coast imports started arriving even earlier as shippers tried to avoid potential disruptions associated with west Coast labor contract negotiations that began in May.

6. "We are handling 33 percent more containers through our terminals than we did in the same period in 2019," Bethann Rooney, director of the Port Authority of New York and New Jersey (PANYNJ), said at a media conference on July 1. An average of 17 container ships were docked outside the ports of New York and New Jersey in the last week of June, after hitting a record 21 on June 20, according to PANYNJ. At one point in June, 107 container ships were waiting to enter the Port of New York and New Jersey, with an average wait time of 4.5 days. So far this year, they have waited an average of 3.8 days, compared to 0 days before the pandemic and the resulting surge in consumer imports!

7. Congestion has also reached critical levels at some Nordic hub ports, with transport and supply chain service providers caught in an endless cycle of logistical challenges, starting with complete terminals and carrier missed schedules, and extending deep inland. Persistent driver shortages and disruptions to inland rail and barge services add to bottlenecks that cannot be relieved even by slowing imports and rapidly deteriorating economic conditions.

8. But more worrying is the prospect of recession + high inflation + geopolitics in Europe and the US

Post time: Jul-08-2022